Siddharth Dalal is a software engineer at The University of Virginia. He is very interested in personal finance and investing.

He blogs about finance at Personal Finance Simplified (http://www.parchayi.com/) and about other topics at http://www.s1dd.com

In my previous article, I detailed some metrics for Pandora (P) like their increasing subscriber base and increasing revenue. However, the primary comment that people had was that I was ignoring Pandora's continued losses. With this article, I will tackle that question. What will it take for Pandora to be profitable?

From my previous article, here is a chart of Pandora's revenue growth

In 2Q 14, Pandora had fewer listener hours than 1q but still managed more revenues. Let's look at Pandora's major expenses next.

As we can see Pandora paid more in licensing in 2Q 14 than it did in 1Q 14. It also seriously stepped up marketing expenses. If Pandora spent at the same levels per billion hours of music listened in 2Q 2014 for both content and marketing, the loss would have been transformed into a $5 million profit translating to about $0.03/share.

However at this stage with increased competition and the launch of Apple's (AAPL) iTunes Radio, Pandora's increased focus on marketing is important. And Pandora did grow revenue faster in the last quarter than its costs as evidenced from the following chart which shows a narrower loss per billion hours listened than the previous quarter in spite of higher expenses.

With the current rate of growth, we can estimate roughly when Pandora will reach profitability.

If Pandora continues down its current path, profitability can come in the next two quarters.

This also provides some insight on what to expect for quarterly results on Nov 21. Basically a much narrower loss. By this chart about 2c/share on revenues of $171 million.

As discussed above Pandora could have been profitable if they spent less on marketing. Pandora could become profitable if their licensing lawsuit helps. Pandora can become profitable by next year even if neither of those happen. So, in conclusion, I feel Pandora management is taking the right steps. Market domination first, profits will come.

==============================

By the Detroit Bear

He blogs about finance at Personal Finance Simplified (http://www.parchayi.com/) and about other topics at http://www.s1dd.com

In my previous article, I detailed some metrics for Pandora (P) like their increasing subscriber base and increasing revenue. However, the primary comment that people had was that I was ignoring Pandora's continued losses. With this article, I will tackle that question. What will it take for Pandora to be profitable?

From my previous article, here is a chart of Pandora's revenue growth

In 2Q 14, Pandora had fewer listener hours than 1q but still managed more revenues. Let's look at Pandora's major expenses next.

As we can see Pandora paid more in licensing in 2Q 14 than it did in 1Q 14. It also seriously stepped up marketing expenses. If Pandora spent at the same levels per billion hours of music listened in 2Q 2014 for both content and marketing, the loss would have been transformed into a $5 million profit translating to about $0.03/share.

However at this stage with increased competition and the launch of Apple's (AAPL) iTunes Radio, Pandora's increased focus on marketing is important. And Pandora did grow revenue faster in the last quarter than its costs as evidenced from the following chart which shows a narrower loss per billion hours listened than the previous quarter in spite of higher expenses.

With the current rate of growth, we can estimate roughly when Pandora will reach profitability.

If Pandora continues down its current path, profitability can come in the next two quarters.

This also provides some insight on what to expect for quarterly results on Nov 21. Basically a much narrower loss. By this chart about 2c/share on revenues of $171 million.

As discussed above Pandora could have been profitable if they spent less on marketing. Pandora could become profitable if their licensing lawsuit helps. Pandora can become profitable by next year even if neither of those happen. So, in conclusion, I feel Pandora management is taking the right steps. Market domination first, profits will come.

==============================

By the Detroit Bear

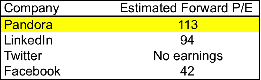

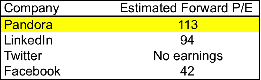

When you're a natural bear like me, you take a look at the valuations of the high-flying tech cohort and you can't help but shudder.

Source: Yahoo Finance.

Facebook (FB) even looks like a bargain at 42x earnings! Normally, such insane valuations cannot be justified, thus warranting a short position. However, I do not believe that logic applies to Pandora (P).

The Short Case Is Excellent

The short case for Pandora is obvious and logical. The company currently pays more for its content than its competitors like terrestrial radio, Sirius XM (SIRI), and Apple's(AAPL) iTunes Radio pay. With sky-high content costs, Pandora has been unable to generate net income for a full year, or -- my favorite metric -- free cash flow. Additionally, the company is facing an onslaught of new competition from web services like Spotify, SongZa, and iTunes Radio. In just a month and a half of competition from Apple's new streaming radio service, Pandora's monthly active users declined sequentially by 1.8 million 70.9 million users. That's a strong number, in my view, considering the amount of time it takes for any new service to ramp.

Total U.S. radio market share notched over 8%, an increase of 30 basis points, and total hours listened were 8% higher than September at 1.47 billion hours. Ultimately, October was a mixed bag, but Pandora should be concerned that competition will intensify going forward. Plus, Apple can afford to engage in any tactic necessary to steal market share from Pandora due to its endless mountain of cash and the overall small impact on Apple's financial performance.

But I'm Not Shorting Pandora

After iTunes Radio launched, my first instinct was to short Pandora -- and I did. The stock fell slightly, but ultimately, the trade was marginally profitable. The short continues to look incredibly attractive on the basis of valuation. I think Pandora is worth somewhere between $12 and $15, a decline of roughly 50% from its current price. However, lurking from beyond lies the destroyer of all shorts -- a potential acquirer with compelling reasons to acquire the company.

Microsoft (MSFT) looms as the most likely bidder, in my view. CEO Steve Ballmer has used the last years of his reign to establish the company inconsumer electronics. Ballmer paid $8.5 billion to acquire Skype in 2011, and the company recently added Nokia's handset business into the fold. These two acquisitions, coupled with the upcoming release of Xbox One, make Pandora a perfect fit for Microsoft.

Since the days of the Zune, Microsoft has struggled to gain any presence in music. Each attempt has fallen flat on its face. The current iteration, Xbox Music, won't even be available for free streaming on the Xbox One. Pandora brings an established brand name with an enormous installed user base. It would be a wonderful compliment for Xbox One. Microsoft hopes the system will be an all-in-one living room entertainment device, and that hope moves closer to reality if Microsoft acquires Pandora and its established music service.

It could also make an interesting addition to the Windows phone product. If sales of the latest Lumia struggle, Microsoft could package a free subscription to Pandora or even make it a Windows exclusive (exclusivity isn't likely, in my view). Xbox Music might not draw customers in, but smartphone integration with Pandora would provide a compelling offering.

Pandora could also fetch a hefty price tag. For comparison, Microsoft purchased Skype for $8.5 billion in 2011 after it had generated a small loss in 2010 on revenue of $860 million. Though this is just a rough valuation, 10x Pandora's FY 2014 revenue would value the company at roughly $6.4 billion -- a 28% premium from its current share price. Yet, Pandora has a much more obvious path to monetization than Skype does, so Microsoft could justify paying 10x FY 2015's revenue estimate of $890 million -- roughly $9 billion. That figure represents roughly 80% upside from current levels.

The Detroit Bear would never pay that much for Pandora, but a departing Steve Ballmer certainly might. Plus, his $80 billion war chest would hardly notice the difference between $6.4 billion and $9 billion, assuming that's what it takes to get a deal done. Microsoft also might hold superior negotiating leverage that could help lower content costs. To top it off,newly appointed CEO Brian McAndrews previously oversaw aQuantive before selling the company to none other than Microsoft. I assume he would be comfortable dealing with Microsoft relative to other companies.

The Bottom Line

Unfortunately, finding shorts in a bull market can be an exercise in torture, and the fact that Pandora could be such a strong strategic investment for Microsoft makes Pandora look even more unattractive from the short side. Famed investor Ricky Sandler of Eminence Capitalloathes shorting individual stocks because he thinks the risk of acquisitions is too great. In the case of Pandora, I could not agree more.

Disclaimer: The Detroit Bear is not a registered investment advisor, so the contents of this article may not fit your personal investment goals or philosophy.

No comments:

Post a Comment